Tag: Athens Business

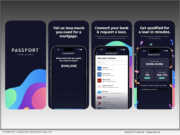

Software: FormFree upgrades Passport Wallet with simpler UI, VantageScore integration and streamlined asset validation

Software NEWS: -- FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

Software: FormFree welcomes MX Founder and Executive Chair Ryan Caldwell to its board of directors

Software NEWS: -- FormFree® today announced the appointment of MX Technologies, Inc. (MX) Founder and Executive Chair Ryan Caldwell to its board of directors. Caldwell brings more than 20 years of experience in financial services and fintech, helping organizations around the world harness the power of financial data to improve business and consumer outcomes.

Software: FormFree partners with original ‘Shark’ and iconic entrepreneur Kevin Harrington to launch Passport portable financial ID

Software NEWS: -- FormFree has partnered with serial entrepreneur Kevin Harrington of "Shark Tank" fame to promote Passport, a free service that makes it easy for consumers to quantify their borrowing power and share their verified assets, employment, annual and residual income and rent payment history with their preferred lender in just minutes from any web-enabled device.

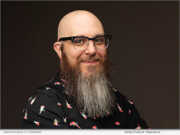

Software: Jonathan Nahil joins FormFree as chief technology officer

Software NEWS: -- FormFree® today announced that it has brought on Jonathan Nahil as chief technology officer (CTO). Nahil possesses more than 20 years of experience as a software architect and leader of development teams at renowned technology organizations.

Software: IndiSoft partners with FormFree to streamline the delivery of housing counseling services to underserved consumers

Software NEWS: -- FormFree® today announced that developer of collaborative solutions for the housing finance industry, IndiSoft, is leveraging FormFree's Passport® to enable HUD-approved housing counseling agencies (HCAs) to provide more effective and expeditious consumer counseling.

Software: GreenLyne adopts FormFree’s Residual Income Knowledge Index to unlock greater inclusivity in mortgage lending

Software NEWS: -- FormFree® today announced that Inclusive-Finance-as-a-Service platform GreenLyne has enhanced its ability to help lenders identify home financing opportunities for underserved consumers with its adoption of FormFree's Residual Income Knowledge Index™ (RIKI™).

Software: FormFree’s AccountChek can now be used by mortgage lenders to satisfy Freddie Mac’s assessment of income requirement for loan applicants...

Software NEWS: -- FormFree® today announced that mortgage lenders can now use AccountChek® to automate income assessment using Freddie Mac Loan Product Advisor® (LPA℠) asset and income modeler (AIM) for borrowers who are paid through ADP.

Software: FormFree releases Residual Income Knowledge Index, an intelligent new system for assessing borrowers’ Ability to Pay, to lenders nationwide

Software NEWS: -- FormFree today announced the general availability of its Residual Income Knowledge Index, or RIKI. RIKI is an innovative method for measuring consumers' Ability-to-Pay (ATP) for mortgages and other loans based on monthly income and spending. When paired with traditional credit scoring models, RIKI offers lenders a more complete understanding of consumers' creditworthiness and creates homeownership opportunities for those with little to no credit history.

Software: FormFree integrates with Docutech to streamline loan production with VOA and VOI/E capture

Software NEWS: -- FormFree® today announced the integration of AccountChek®, a service that allows lenders to verify borrowers' assets, income, employment and rent payment history, with Solex®, a comprehensive eDelivery, eSign, eClose and eVault platform from Docutech®, a First American company.

Software: FormFree and Finastra partnership streamlines borrower verification for improved mortgage loan processing

Software NEWS: -- Finastra and FormFree®, a market-leading fintech company that enables lenders to understand people's true ability to pay (ATP®), have partnered to further streamline electronic borrower verification for mortgage lenders.

Software: FormFree and HomeScout partner to help lenders identify mortgage-ready borrowers earlier in the home buying journey

Software NEWS: -- FormFree® has partnered with HomeScout, a wholly owned subsidiary of FirstClose®, to launch HomeScout Qualified Borrower, a tool that helps lenders generate leads and concentrate borrower conversion efforts on mortgage-ready home buyers.

Software: FormFree announces support for new Freddie Mac Loan Product Advisor enhancement aimed at expanding sustainable homeownership for renters

Software NEWS: -- FormFree® announced that mortgage lenders using AccountChek® verification of asset (VOA) reports in conjunction with a Freddie Mac Loan Product Advisor® (LPA℠) solution will soon benefit from an enhancement that takes loan applicants' 12-month on-time rent payment history into consideration when assessing eligibility for qualified first-time homebuyers.

Software: Mortgage lenders are now able to use FormFree AccountChek to satisfy Freddie Mac’s reverification of employment requirement

Software NEWS: -- FormFree® today announced that its AccountChek® digital asset verification service supports a new enhancement to Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution that makes assessment of borrower employment easier, faster, less expensive and more fraud-resistant.

Software: FormFree and Take3Tech integration brings AccountChek asset, income and employment verification to the LoanMAPS mortgage technology platform

Software NEWS: -- FormFree® today announced it has partnered with Take Three Technologies (Take3Tech) to make its AccountChek® automated asset, income, and employment verification solutions available within LoanMAPS™, an all-in-one loan origination platform that encompasses a loan origination system (LOS), point-of-sale system (POS), customer relationship management system (CRM), compliance monitoring and report generation.

Software: FormFree grows executive team, appoints Eric Lapin chief strategy officer

Software NEWS: -- FormFree® today announced that it has appointed Eric Lapin to the role of chief strategy officer (CSO). In this position, Lapin will leverage his more than 25 years' experience in leadership roles at marquee mortgage technology firms and financial institutions to steer the strategic vision and partnerships driving FormFree's growth.

Software: George Mason Mortgage selects FormFree AccountChek to streamline its verification of borrower assets, income and employment

Software NEWS: -- FormFree® today announced that Washington, D.C.-based George Mason Mortgage (GMM) has selected AccountChek® as the regional lender's exclusive provider of automated asset, income and employment verification services. GMM will use AccountChek to simplify the loan application experience for borrowers, improve productivity for its team of 120 mortgage loan officers and reduce loan cycle times.

Software: Mary Costello joins FormFree team as director of vendor management, risk and compliance

Software NEWS: -- FormFree today announced that it has welcomed 17-year finance industry veteran Mary Costello to its team as director of vendor management, risk and compliance. In this role, Costello will support FormFree's audit, risk and compliance efforts across the management of internal and external vendor, lender and integration partnerships.

Software: FormFree names former ICE finance executive Patrick Rutherford as CFO to fuel its next stage in company growth

Software NEWS: -- FormFree today announced that it has appointed Patrick Rutherford, former finance executive at Intercontinental Exchange (NYSE: ICE), as chief financial officer (CFO). In his new role at FormFree, Rutherford will lead the organization's finance, accounting and compliance functions.

Software: FormFree’s AccountChek joins forces with Freddie Mac for industry-first automated assessment of direct deposit income

Software NEWS: -- FormFree® today announced that its AccountChek® digital asset verification service will support a first-of-its-kind solution from Freddie Mac that allows mortgage lenders to assess a prospective homebuyer's income using direct deposit data. Available to mortgage lenders nationwide, Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution fulfills mortgage verification of assets (VOA) and verification of income (VOI) requirements.

Software: FormFree integration with OpenClose enhances lending experience with quick and easy borrower-permissioned data verification

Software NEWS: -- FormFree® Founder and CEO Brent Chandler today announced the availability of its AccountChek® financial data verification service within OpenClose®, the leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders. The integration embeds AccountChek into OpenClose's ConsumerAssist(tm) Enterprise POS and LenderAssist(tm) LOS, giving borrowers the freedom to electronically permission verification data with ease when applying for a mortgage loan.