Tag: FinTech

Software: Truity Credit Union inks deal to implement the Empower LOS from Dark Matter Technologies

Software NEWS: -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today welcomed Truity Credit Union (Truity) as the latest financial institution to select the Empower® loan origination system. A member-owned credit union with locations in Oklahoma, Kansas and Texas, Truity will leverage the Empower LOS to provide loan officers and members a modern, mobile-friendly experience.

Software: OneTrust Home Loans Selects LenderLogix’s Fee Chaser to Eliminate Manual Processes

Software NEWS: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced OneTrust Home Loans as its newest Fee Chaser client. Using Fee Chaser, OneTrust Home Loans can streamline its operations and compliantly collect upfront fees from its borrowers.

Software: Dark Matter Technologies appoints former Ellie Mae executive as deputy chief product officer

Software NEWS: -- Dark Matter Technologies (Dark Matter) today announced the appointment of Vikas Rao as deputy chief product officer. Reporting directly to Chief Product Officer Stephanie Durflinger, Rao is charged with overseeing enhancements to the Empower® loan origination system (LOS) and establishing Dark Matter's developer community, which will help lenders embed automation deeper in their origination workflows and more tightly integrate their systems using open application programming interfaces (APIs) and widgets.

Software: Down Payment Resource integration with ICE Mortgage Technology embeds down payment assistance program support into core mortgage origination software

Software NEWS: -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced a new integration using the latest API framework from Intercontinental Exchange (ICE) for mortgage technology. Available via the Encompass Partner Connect™ API Platform, the integration makes it easier for lenders to support homebuyers with the nation's 2,300-plus down payment assistance (DPA) programs.

Software: New Solution Connects API-Driven Back-End Execution to Front-End Pricing with Industry-First Features

Software NEWS: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of the Base Rate Generator, an industry-changing solution that allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions. By combining live agency API connections, co-issue executions, aggregator pricing, and custom TBA indications, the MCT Base Rate Generator allows mortgage lenders to improve margin management and competitive performance.

Software: ACES Quality Management Partners with Infrrd to Provide AI-Powered Intelligent Mortgage Document Processing

Software NEWS: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced a new partnership with Infrrd to provide ACES users access to intelligent document processing. When used in conjunction with ACES Quality Management & Control software, Infrrd's technology helps lenders improve the efficiency of their quality control (QC) reviews by indexing, categorizing and reviewing the accuracy of loan file documents prior to review.

Software: Monterra Credit Union elevates the member experience with the Empower LOS from Dark Matter Technologies

Software NEWS: -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that Monterra Credit Union (Monterra CU), a full-service financial institution serving members throughout San Mateo County, California, the City of Palo Alto and the San Francisco Bay Area, has selected the Empower® loan origination system (LOS) for mortgage loan, home-equity loan and home-equity line of credit (HELOC) originations.

Software: Down Payment Resource brings its award-winning homebuyer assistance software to The Mortgage Collaborative as a preferred partner

Software NEWS: -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced that it has joined The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry. As a member of TMC's Preferred Partner Network, DPR will provide its software, which provides operational support for utilizing its database of more than 2,300 down payment assistance (DPA) programs, at a discounted rate to TMC members.

Software: Dark Matter and Total Expert partner to boost lender revenue through best-in-class mortgage automation and customer engagement

Software NEWS: -- Dark Matter Technologies (Dark Matter) today announced a new strategic partnership with Total Expert, the customer engagement platform purpose-built for modern financial institutions. A forthcoming bi-directional integration between Total Expert and the Empower® loan origination system (LOS) from Dark Matter will empower mortgage lenders to generate more leads, improve sales productivity and close more loans by intelligently automating and personalizing the homebuyer journey.

Software: MCT Launches Complete Best Execution, Now Including Fully Integrated Retain vs. Release MSR Decisioning

Software NEWS: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, proudly introduces a game-changing advancement: a Best Ex for Released and Retained all in one platform!

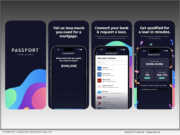

Software: FormFree upgrades Passport Wallet with simpler UI, VantageScore integration and streamlined asset validation

Software NEWS: -- FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

Software: Patelco Credit Union selects the Empower LOS to streamline and bolster home loan and home-equity origination

Software NEWS: -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the implementation of the Empower® loan origination system (LOS) by Patelco Credit Union (Patelco), a Bay Area-based credit union dedicated to the financial wellness of its team, members and communities.

Software: Floify supports Truv’s verification of borrower income and employment service via new integration

Software NEWS: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced an integration with Truv, a consumer-permissioned data platform. The integration enables borrowers to electronically verify their income and employment as they apply for a mortgage loan.

Software: Floify prepopulates loan applications for borrowers using data on file in Total Expert

Software NEWS: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced an enhanced integration with customer engagement platform Total Expert. This collaboration enables loan originators to effortlessly send pre-populated loan applications to borrowers, leveraging the existing data within Total Expert. This feature is designed to streamline the loan origination process for lenders and enhance the application experience for borrowers by reducing redundant data entry.

Software: Blue Sage Solutions and The Mortgage Collaborative Partner to Bring Interim Servicing to their Members

Software NEWS: -- The Mortgage Collaborative, the nation's largest independent mortgage cooperative, announced the addition of Blue Sage Solutions, an industry leader in innovative cloud-based technology providers, to bring interim servicing to the mortgage industry. The partnership makes the Blue Sage Digital Servicing Platform (DSP), a cloud-based system that provides all necessary functions to perform interim servicing, available to TMC members at preferred rates.

Software: SmartBuy DPA Now Available to The Mortgage Collaborative’s Lender Members

Software NEWS: -- Click n' Close, a multi-state mortgage lender, today announced its Preferred Partner status with The Mortgage Collaborative (TMC), a leader in mortgage cooperatives dedicated to providing its members with cutting-edge technology and expert mortgage banking resources.

Software: Argyle brings the mortgage industry’s highest-converting VOIE platform to The Mortgage Collaborative

Software NEWS: -- Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, has joined The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, as a preferred partner. As a member of TMC's Preferred Partner Network, Argyle will provide the cooperative's lender members discounted access to its exemplary customer service and award-winning income and employment verification (VOIE) services, which outperform legacy verification services for a fraction of their cost.

Software: Floify introduces flexible pricing with the introduction of Lender Edition

Software NEWS: -- Floify, the mortgage industry's leading point-of-sale (POS), today announced the launch of Lender Edition, a newly badged version of the popular mortgage point-of-sale that introduces a flexible per-loan pricing option for mortgage lenders. Floify Lender Edition is the counterpart to Broker Edition, a one-stop lending platform configured for the needs of mortgage brokers that was introduced in December 2023.

Software: Informative Research Announces Mortgage Lenders Using Fannie Mae’s Desktop Underwriter Can Now Validate Income and Employment with AccountChek

Software NEWS: -- GARDEN GROVE, Calif., March 7, 2024 (SEND2PRESS NEWSWIRE) -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced that lenders using Fannie Mae's Desktop Underwriter® (DU®) can now leverage a 12-month asset verification report to validate income and employment in addition to assets with a single asset report. By using direct deposit banking data to evaluate income and employment, lenders can streamline processes and improve the borrower experience.

Software: LenderLogix Announces POS Integration with Informative Research’s AccountChek to Enhance the Mortgage Borrower Experience

Software NEWS: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks and brokers, announced the integration of AccountChek by Informative Research into its point-of-sale system LiteSpeed. This integration blends AccountChek's pioneering verification technology into LiteSpeed to seamlessly enhance the borrower experience and optimize the loan origination process to ensure a smooth experience for borrowers and users alike.